TAX FORM NOTICE

DOES has mailed copies of tax form 1099-G Certain Government Payments to individuals who received unemployment insurance benefits in tax year 2023. You can access this form by logging into your claimant portal. For detailed information on form 1099-G, please see our Frequently Asked Questions.

IMPORTANT STEPS FOR YOU

There are exciting changes that we have made to enhance your experience with the Unemployment Insurance Benefits System (UIBS) at the DC Department of Employment Services (DOES).

Quick Documents

Important Steps for You:

What’s New?

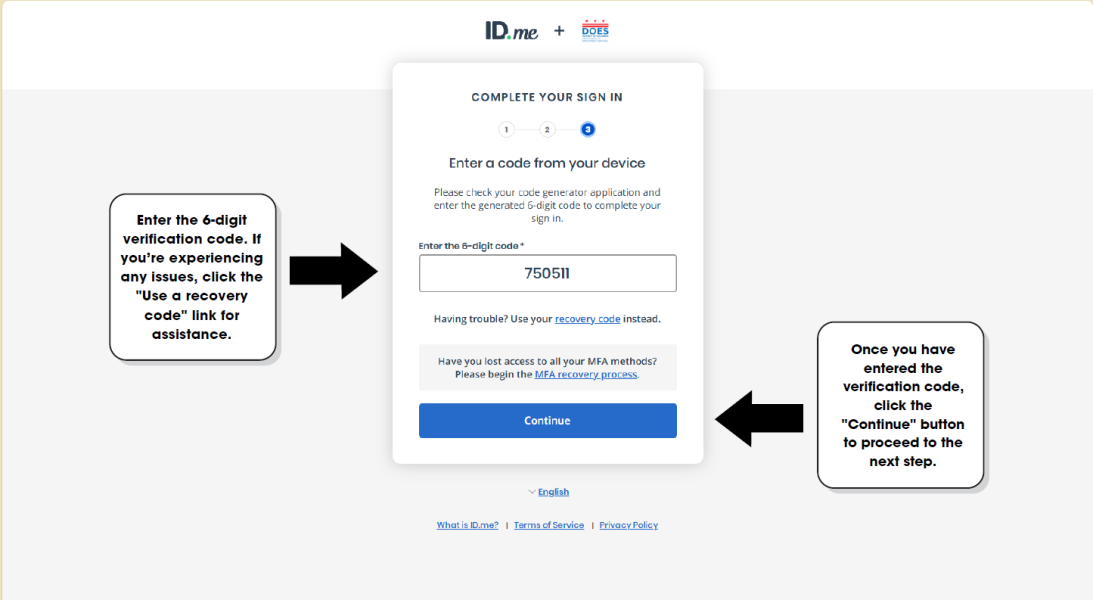

Starting the evening of Thursday, September 4th, 2025, all users will log-in to DCNetworks and the Unemployment Insurance Benefits System (UIBS) using ID.me Single-Sign-On (SSO).

What does this mean? It means users will now have one set of credentials for both systems instead of separate usernames and passwords, including Multi-Factor Authentication (MFA) that is added for enhanced account security.

How to Log In:

See the images below for step-by-step instructions to log in using ID.me SSO.

Steps for You:

1. If you already have an ID.me account, created within the past 12 months, you can log in using your existing credentials.

2. If you don’t remember your password, go to ID.me to reset it or chat with a representative.

3. Remember, ID.me can also be used for services like the Internal Revenue Service or Social Security Administration access.

4. If you need help:

For ID.me issues, visit help.ID.me

For DC Unemployment Insurance Benefits issues, contact DOES at (202)-724-7000 (DOES cannot reset ID.me passwords.)

WAGE REQUIREMENTS TO RECEIVE UI

To receive unemployment benefits, you must earn a certain amount of income within a 12-month period called the base period. The base period is determined by the date you filed your initial claim for benefits.

|

If the first full week of your claim is in the month of: |

Your base period is the 12 months that ended on the previous: |

|---|---|

|

January, February, or March |

September 30 |

|

April, May, or June |

December 31 |

|

July, August, or September |

March 31 |

|

October, November, or December |

June 30 |

For example, if the first full week of your claim is on March 1, 2021, then your base period is October 1, 2019 to September 30, 2020.

You must meet the following wage requirements to be eligible for UI:

- You made at least $1,300 in wages in one quarter of the base period;

- You must have wages in at least two quarters of the base period;

- You must have earned at least $1,950 in wages for the entire base period; and

- The total amount you earned during the base period must be at least one and a half (1.5) times the wages in your highest quarter or be within $70 of that amount.

Base period wages may be from District employers, the District Government, the Federal Government, the US Military, or employers in other states.

SAMPLE SCENARIO: Tom lost his job as a plumber because his company had to downsize. If Tom’s first full week of benefit claim is the week of July 5, 2021, then his 12-month base period is April 1, 2020 through March 31, 2021.

Based on the chart below, Tom would be able to receive unemployment benefits. He meets the wage requirements.

|

Base Period |

||

|---|---|---|

Quarter 1(April – June 2020) |

Quarter 2(July – September 2020) |

Total wages: $2,100 |

|

Wages: $700 |

Wages: $1,400 |

|

|

$1,400 x 1.5 = $2,100 |

||

AMOUNT OF MONEY RECEIVED WITH UI

The amount of money you receive as your weekly benefit is based on the highest amount of money you earned in one quarter during the base period. All claimants can receive a standard 26 weeks of benefits. The maximum weekly benefit amount you may receive is $444.

You may collect benefits up to your maximum benefit amount for weeks that fall within your benefit year. Your benefit year is the 52-week period that begins with the Sunday of the week when you first filed your claim for benefits.

You may not file a new unemployment claim until your current benefit year has ended. However, if you use up your benefits before your benefit year is over, you may be able to file a new claim in another state if you have worked in that state and you meet that state’s requirements for filing a claim.

WHEN TO EXPECT YOUR FIRST CLAIM PAYMENT

Within a week after you file your initial claim, you should receive a Notice of Monetary Determination by mail.

This notice will let you know:

- If you made enough wages to get unemployment benefits

- What your weekly benefit amount will be

- What your maximum benefit amount will be

- The date your benefits will end

- The base period of your claim

- Which wages were used to calculate your benefits

As of September 5, 2021, under District law, there is a one-week waiting period before benefits are paid. The waiting period is the first week for which you would otherwise be eligible. Generally, this is the first week of your claim. No payment is made during the waiting period. If you are denied from receiving benefits, the notice will show which requirement you did not meet.

DISQUALIFICATION FROM RECEIVING BENEFITS

You may be disqualified from receiving benefits if you:

- Voluntarily left your job without good cause

- Were fired from your job for any type of misconduct

- Refused to apply for or accept suitable work without good cause

- Participated in a labor dispute other than a lockout

- Were unable to work or unavailable for work

- Failed to report wages as directed

- Did not participate in designated reemployment services

- Did not attend a training course recommended by the Department of Employment Services

- Are not authorized to work in the United States

A list of exceptions to disqualifications and ineligibilities can be found in the Claimant’s Rights and Responsibilities Handbook (page 8). If you are disqualified to receive benefits, you will be mailed a written Notice of Determination from a claims examiner to inform you why you were disqualified, and the period covered by the decision. If you disagree with the decision, you have the right to file an appeal with the Office of Administrative Hearings (OAH).